Increasing your audit rating by addressing open audit issues is an effective strategy for your organization. An open audit allows the audit committee …

How Addressing Open Audit Issues Can Help Increase Your Audit RatingRead More

Increasing your audit rating by addressing open audit issues is an effective strategy for your organization. An open audit allows the audit committee …

How Addressing Open Audit Issues Can Help Increase Your Audit RatingRead More

Operating with a specific goal or mission is the main purpose of a nonprofit organization. Functioning as a nonprofit, your organization must continue …

Private Foundations and Public Charities – What’s the Difference?Read More

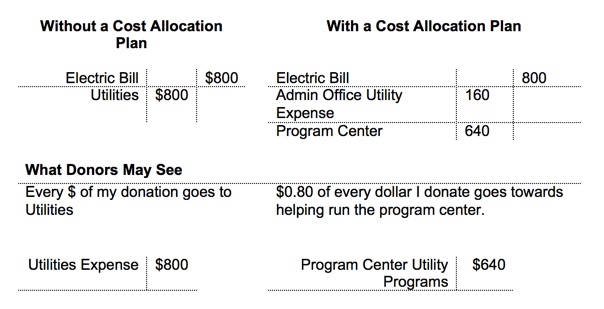

Developing a cost allocation plan for a nonprofit organization can be a tricky process. Understanding how a cost allocation plan (CAP) works is …

Why a Cost Allocation Plan is Important for NonprofitsRead More

During the holiday season, thoughts turn to gift giving. Many employers choose this joyous season to recognize and celebrate with their employees. …

When it comes to defining the term “audit,” it has several meanings. While it can mean Internal Review, External Management, or Contract Monitoring, …

While nonprofits have a wide range of objectives, their general charter is to accumulate and distribute funds to address specific social objectives …

When planning for an audit of your 401(k) or other retirement plan, you might question if a full scope audit or limited scope audit should be …

Full Scope or Limited Scope Audit – Which One and Why?Read More

Running a small business is a big task. Between the everyday tasks at the core of your company and keeping your staff and customers happy, you may be …

Why Does My Small Business Need to Keep All These Accounting Records?Read More

The process of buying or selling a home is often mind-boggling. Misinformation about the tax implications of real estate sales abound and it is easy …