Developing a cost allocation plan for a nonprofit organization can be a tricky process. Understanding how a cost allocation plan (CAP) works is critical to responsible financial management and reporting; however, not all nonprofit organizations realize its importance. How costs are allocated affects the public view of your nonprofit and can greatly impact your ability to receive funding.

What is a Cost Allocation Plan?

Simply put, a cost allocation plan is the method used for allocating expenses that are not directly tied to a particular activity. It is your plan for allocating expenses that benefit more than one activity. When donors look at your financial reporting, they expect to see a clear picture of how their funds are being spent. In fact, formally allocating costs is required by governmental agencies and most major funders.

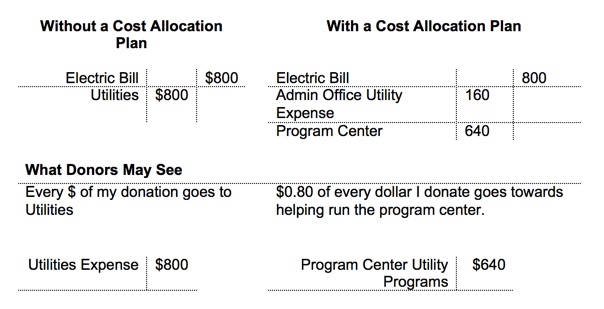

A cost allocation plan allows your nonprofit to communicate the true costs of providing certain services. For example, when your monthly electric bill for $800 arrives, rather than coding it simply as “utilities,” you would divide it out between the different functional areas that actually utilized that electricity. If your administrative office was responsible for approximately 20% of its use and your program center utilized 80%, it would be divided as follows:

The Importance of Cost Allocation

When done accurately and consistently, allocating costs will provide a true picture of what your different programs and activities cost. How you allocate your costs will also determine the percentage of management, program and fundraising costs that will be reflected on your IRS Form 990 and other financial reports. This is important because these forms are utilized by potential donors to ensure that your organization is using its funds wisely. Especially when it comes to government funding, how funds are allocated will determine what costs are reimbursable. When a large percentage of costs are allocated to fundraising efforts, many funders will not consider your organization’s request for a donation. Why? Donors tend to give when their dollars go directly to mission critical programs and services.

When it comes to allocating costs, one of the largest expenses and most complicated of those requiring allocation is payroll. Some staff positions are easily categorized, but some positions, particularly those in the management or administrative realm can actually be divided based on the nature of a job and how much time and effort is devoted to a particular activity.

No matter the size or nature of your nonprofit organization, creating a cost allocation plan is a must. By determining how your funds are utilized, you can better communicate the value of your work, the importance of donor giving and how together you are making positive changes in the community.

At Ernst Wintter & Associates, our nonprofit audit services will give you peace of mind and help you decide how to best utilize your financial resources. If you have any questions about our nonprofit services, one of our CPAs would be happy to speak with you at (925) 933-2626 or, email us at info@winttercpa.com.

This post originally appeared at Ernst Wintter & Associates LLP.